I filed an insurance claim. I got a private investigator instead.

Helping you understand personal finance better, one story at a time.

Dear reader,

First of all, a big and hearty thank you to more than 16,000 of you who are subscribed to this newsletter. The reception couldn’t have been better. If you feel our work is worth sharing, please do so at the click of this button:

With banks slashing savings account rates to just 2.75%, is it time for a saver’s rebellion?

Mutual Funds and fintechs are on the cusp of technologies that cut out banks completely. One such startup called Curie Money has integrated with UPI such that you can make payments directly from your liquid fund.

Is that even legal, you ask?

Well, yes. The Securities and Exchange Board of India (Sebi) instant redemption of up to ₹50,000 per AMC from liquid funds. The mechanics of how this works — and what it means for you — is something Anil Poste and I break down in Thursday’s story.

The Mint Money team is doing a series of events around India on global investing. The next session is scheduled for 9th May at the India Habitat Centre in New Delhi. If you'd like to register for this session, there is an early bird discount. Click on the button to register:

Our week’s work

We started the week with a headline-maker: Saurabh Mukherjea has moved 40% of his personal portfolio into global equities. He manages a PMS out of GIFT City — India’s offshore financial hub — but the real buzz came from our Guru Portfolio interview, where he revealed his retirement target: ₹20 crore in today’s money. Interestingly, Mukherjea doesn’t count his stake in Marcellus Investment Managers towards that goal. Given how illiquid unlisted holdings can be, his logic isn’t entirely off — cash in the bank or a liquid security feels far more real than a paper valuation.

On Tuesday, Shipra Singh reported on a troubling trend: insurers hiring private detectives to investigate suspicious claims. Industry insiders told her that 10-15% of these investigations uncover fraud. But there’s a flip side—customers are increasingly angered by the detectives’ intrusive, often humiliating methods. For families already dealing with medical stress, being grilled about whether a hospital admission was truly necessary—or if home care would have sufficed—can feel especially cruel.

On Wednesday, Sashind profiled Arun Kumar of FundsIndia—the poster child for a disciplined mutual fund investor. Kumar allocates 55% of his portfolio to flexicap and value-oriented funds, 5% to midcaps, 15% to overseas ETFs and stocks, 10% to debt, and uses the remaining 15% for tactical bets—currently parked in a single banking stock.

Kumar also brings a unique perspective to asset allocation. He believes investors should stay aggressive as long as their active income—salary or business earnings—meaningfully adds to their corpus (he defines this as >5% annual growth). But once the portfolio gets large enough that active income barely moves the needle, he says, it's time to turn conservative.

On Friday, Aprajita wraps up the week with a story on the complexities of transmitting EPF after death. While the process is already a maze for living account holders, it becomes significantly more challenging for families after a loved one passes. One example: while you can designate anyone as an EPF nominee, the EPS pension (capped at ₹7,500) can only be disbursed to your spouse and children.

Extra food for thought

For employees, the tax-free limit is set at ₹12 lakh, but what about businessmen? Is it ₹2 crore if you opt for the Section 44AD (presumptive tax)? Under this, you can declare 6% profits on turnover and pay zero tax. However, there are complications. First, if your savings or investments don’t align with the ‘presumed’ profit, you could face litigation. Second, for turnover above ₹20 lakh (₹40 lakh for manufacturing businesses), GST becomes applicable. Third, non-business income like interest or dividends will still be taxed. Read Shipra Singh’s detailed story for more insights.

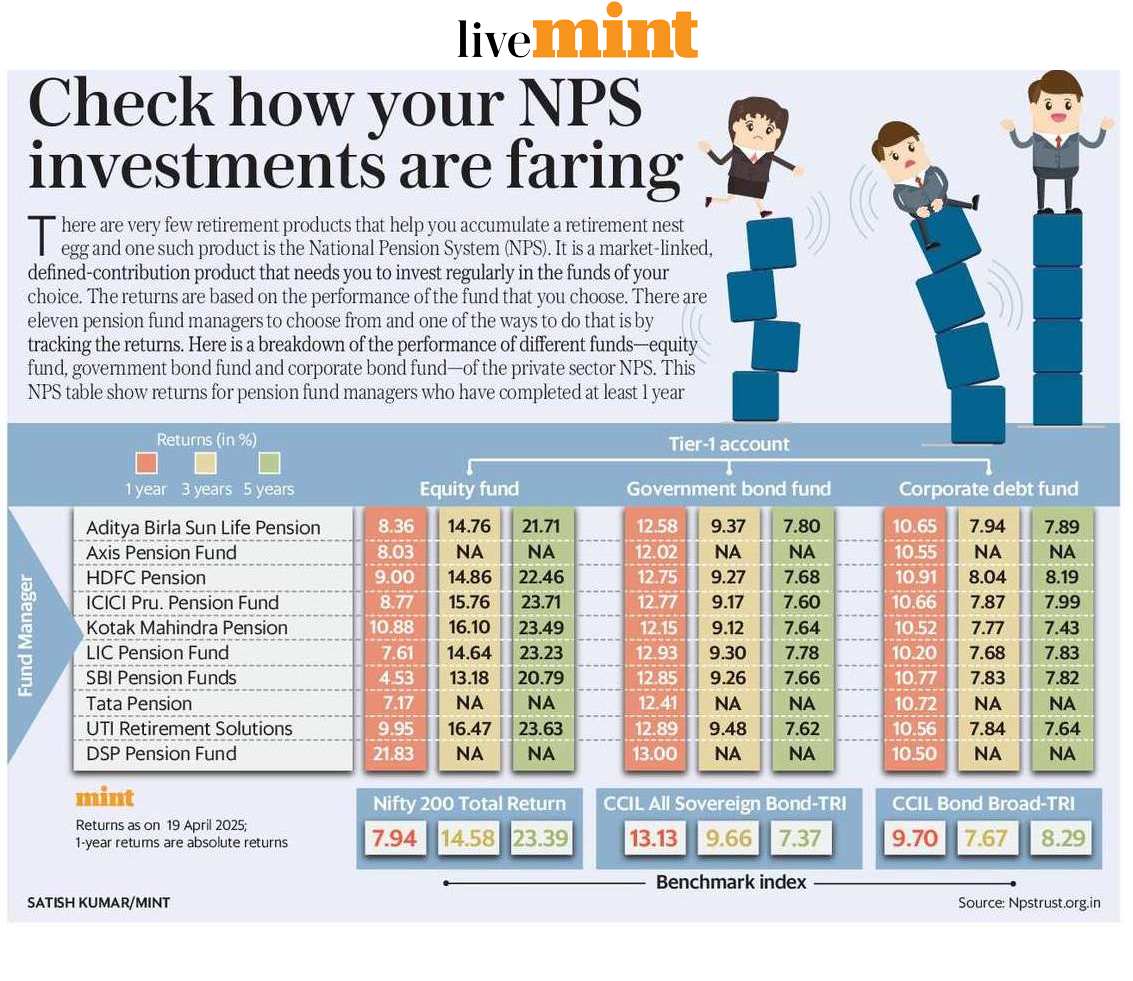

Fiscally responsible graphics

I’m a big proponent of the National Pension Scheme (NPS). Sure, it has its detractors, but it is a great long-term investment option for everyone, regardless of their incomes. Here’s how NPS funds perform:

Social media funnies

What caught our attention on Twitter or LinkedIn this week.

Source: @kanilmalviya

That’s all for this week. If you have any feedback, criticism, or generally want to vent about the state of your portfolio, do reply to this newsletter. Rest assured, I will read every one of your replies.

Best,

Neil Borate

Deputy Editor

Mint